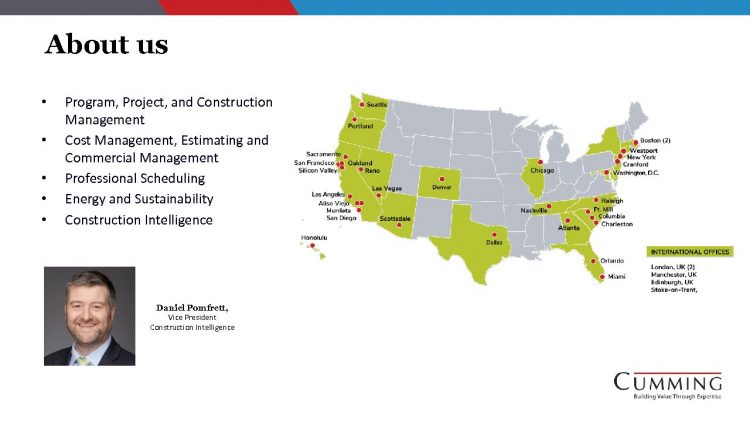

With over 20 years of industry experience and a special knowledge of high end residential and luxury hospitality projects, Cumming Crop. Vice President Daniel Pomfrett, brings insights on design and construction budgeting for your projects based on market data and analytics related to the construction industry. Watch the webinar or listen to Podcast for an in-depth forecasting of trends in different regions and a better understanding of factors that affect projects directly and indirectly. (See presentation slides below)

Pandemic Affect vs Long-Term Effects

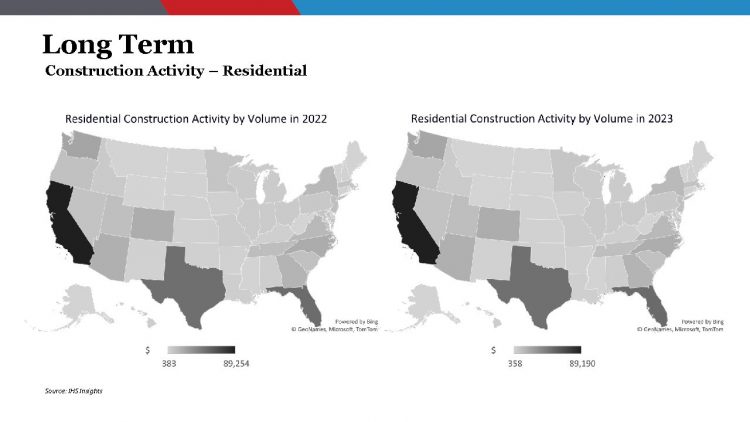

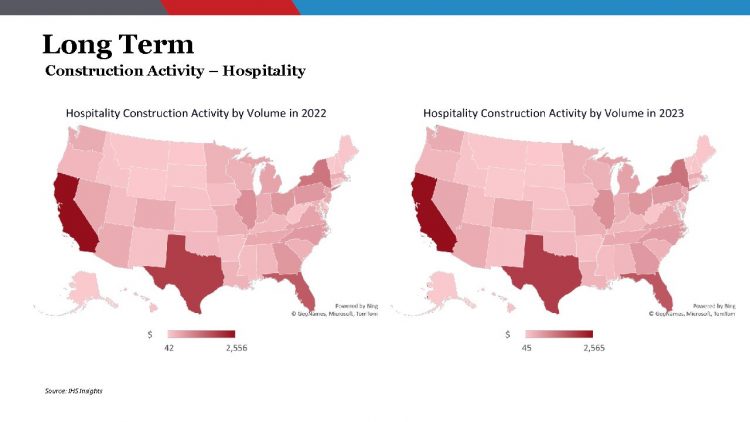

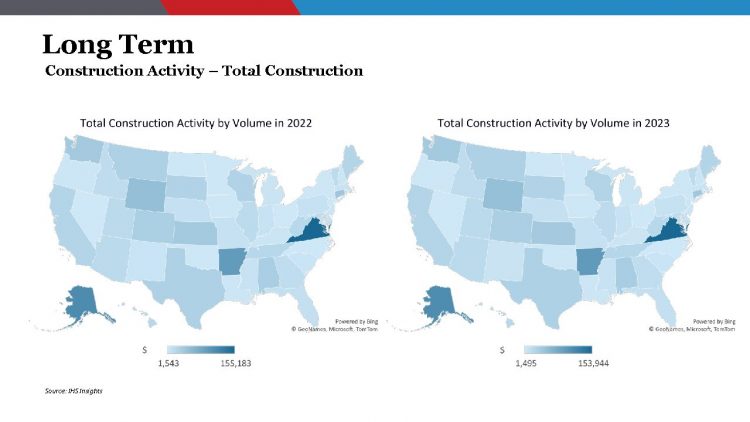

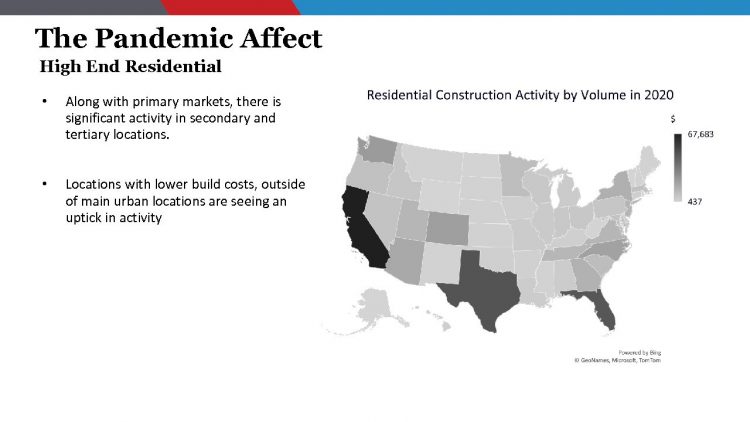

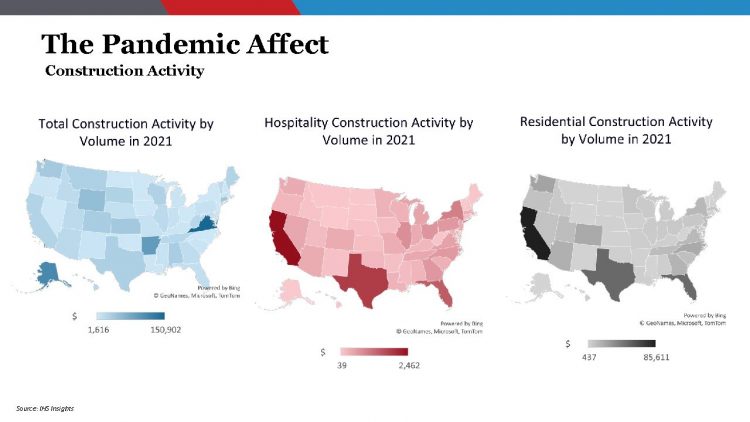

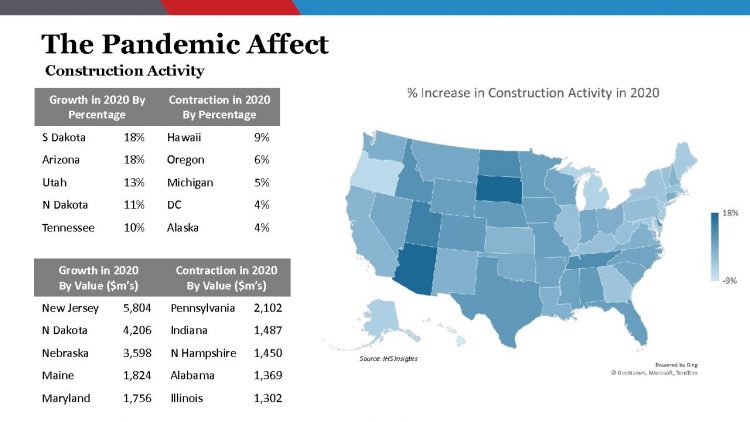

Construction Activity

- Construction activity in 2020 continued and in many places it increased

- Hospitality and residential construction in the southern states, particularly in wealthier areas. is where we are seeing a big uptick.

- 85% of migration is related to lifestyle choices; more space, lower taxes, lower cost of living.

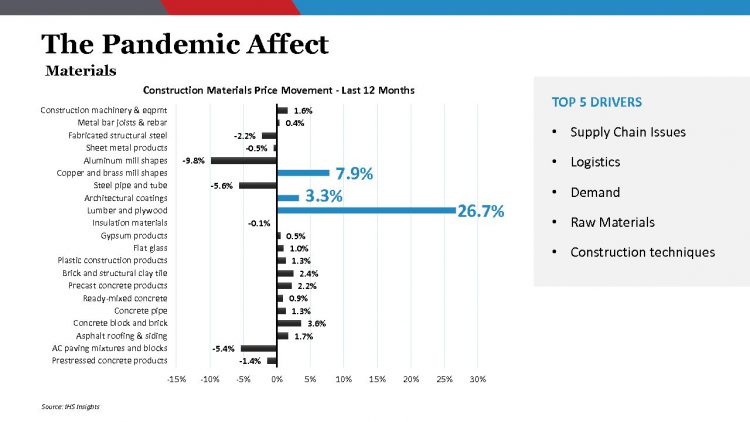

Materials

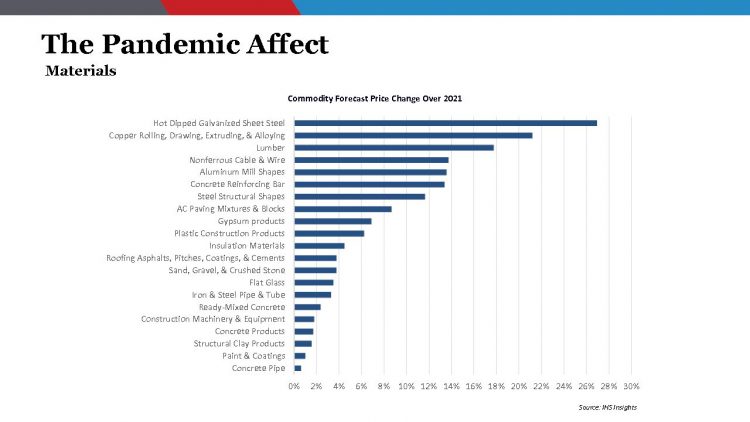

- Raw materials are typically 25-30% of the cost of a project.

- The change in price of construction materials has been driven by supply chain issues, logistics, demand, raw materials and construction techniques.

- Supply chain has really been the biggest issue. It takes a long time and a large financial commitment to start and stop a mill, they can’t react at the speed needed to supply those markets.

- Disruption to movement of goods such air freight, resulted in significant logistics issues.

- Pre-pandemic, there was already a shift towards US based manufacturing because of tariffs. This shift was accelerated during the pandemic due to the lack of dependability and restrictions to import goods.

- We also experienced some disasters in different parts of the world that affected the supply for raw materials.

- People have also change their approach to construction world, finding replacements for materials there were unavailable and showing more interest in green technologies.

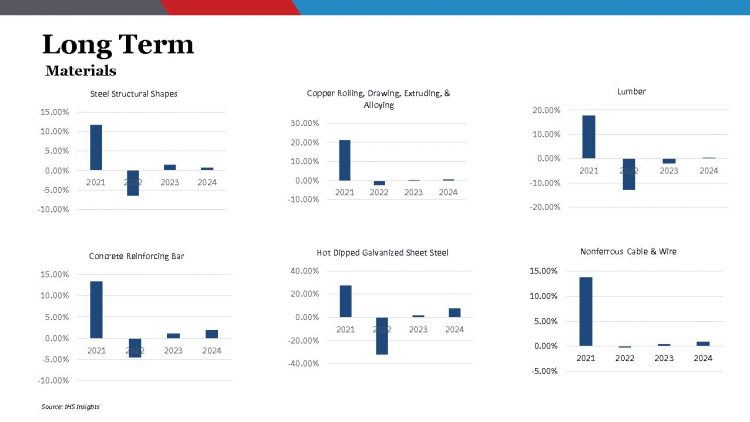

- Although the price of lumber and copper have increased significantly, heavier building materials such as concrete and brick have only seen a small increase and steel has actually seen a slight decrease.

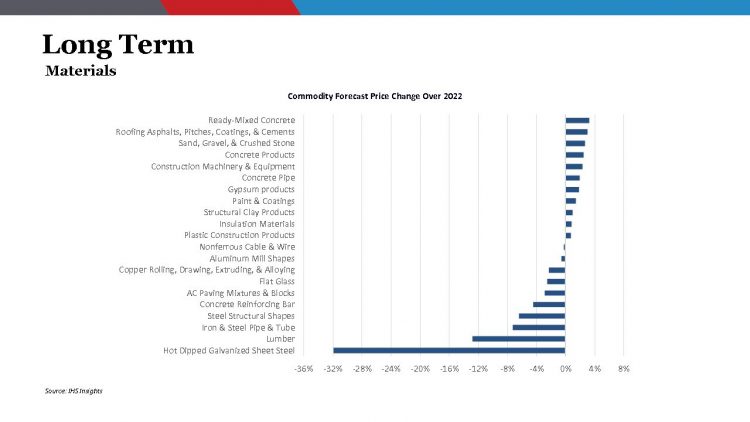

Commodity Price Change Forecast

- Over the next 6 months there is going to be peak in prices as we come towards the end of the year.

- As people regain more confidence, we will continue to see and increase in projects and possibly and exponential increase in the price of materials.

- Keeping up to speed with market changes is really key.

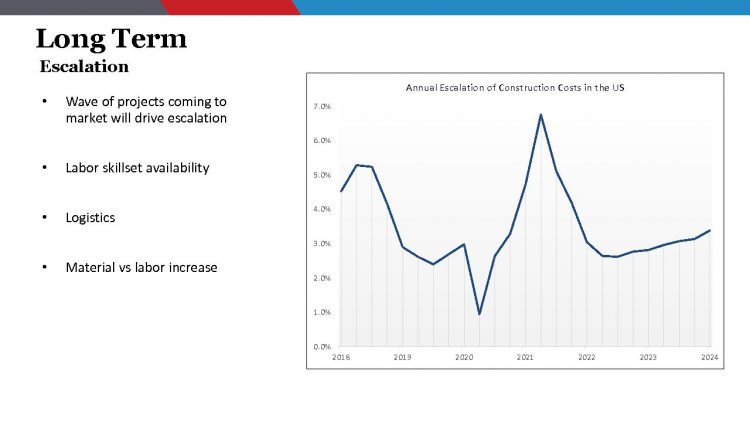

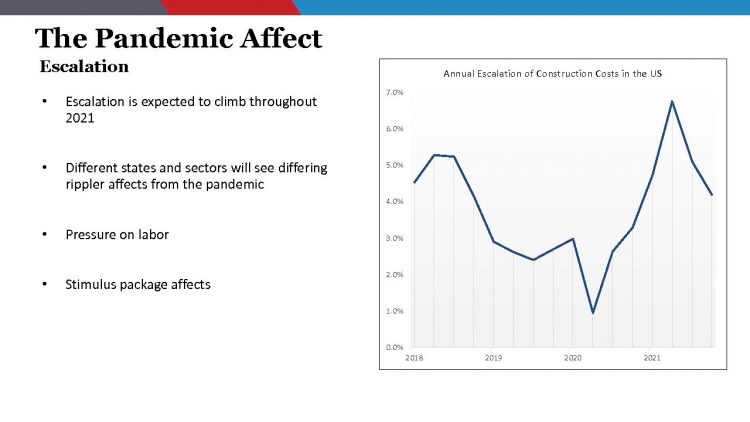

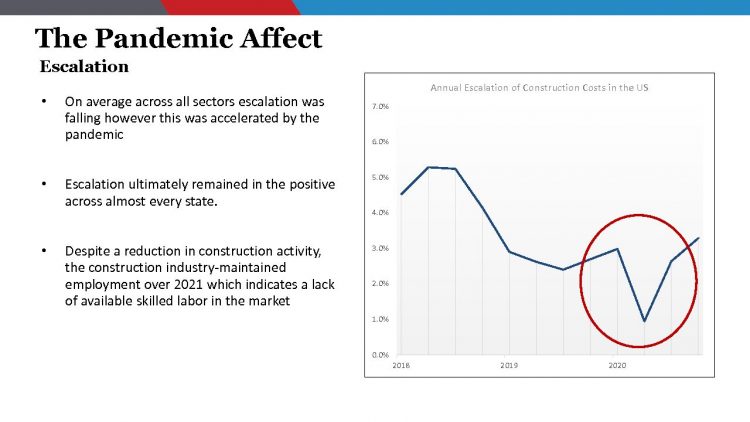

Escalation

- It fluctuated between 2018 and 2019.

- Escalation peaked in 2018 because the increase in demand for high end construction affected the ability to get labor and materials.

- It then began to decrease and this decline was further accelerated by the pandemic but it still remain in the positive.

- Despite a reduction in construction activity in the beginning of the pandemic the industry maintained employment which indicated lack of available labor in the market.

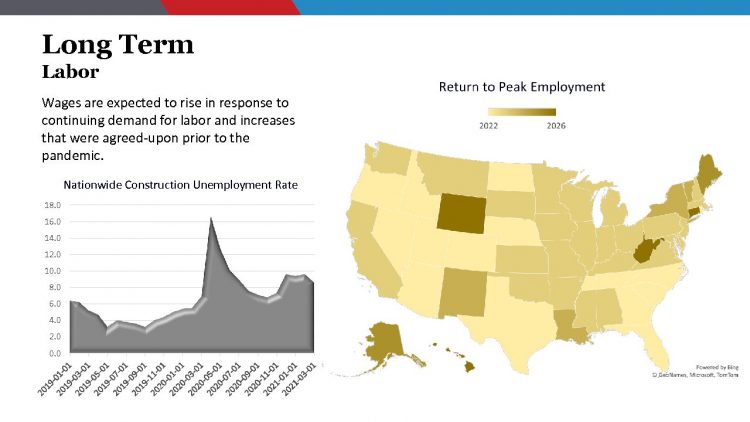

Escalation Forecast

- Expected to continue to climb throughout 2021.

- There is a pressure on labor. Although construction added labor during the pandemic,

- There was already a lack of skillset availability in labor prior to the pandemic, now as demand for work increases, we will see a peak in escalation, potentially taking us back to 2018 levels.

- Stimulus package proposed by the government is getting through and there are two schools of thought about this. On one hand, it brings money and jobs back to the economy but on the other hand the labor market is already stretched, demand has increased material prices so adding more work help or hinder because contractors will get busier and will become more selective.

- Luxury residential and hospitality is already very niche, a lot of the same contractors and design firms are being used. Now we are starting to see firms and contractors merge sectors or move into new ones, especially those that were focused on hospitality.

- The concern is how much of the work we’ll be able to take on given the labor we have and when will we see more labor with the right skillset come into the market? There is a lot of pressure on labor and its availability will be driving prices.

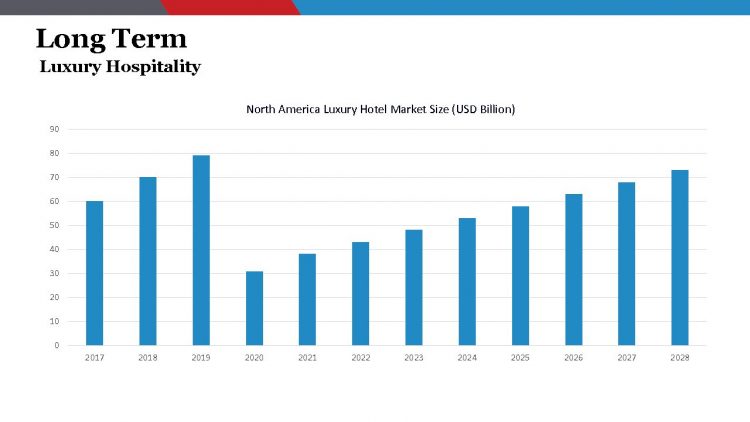

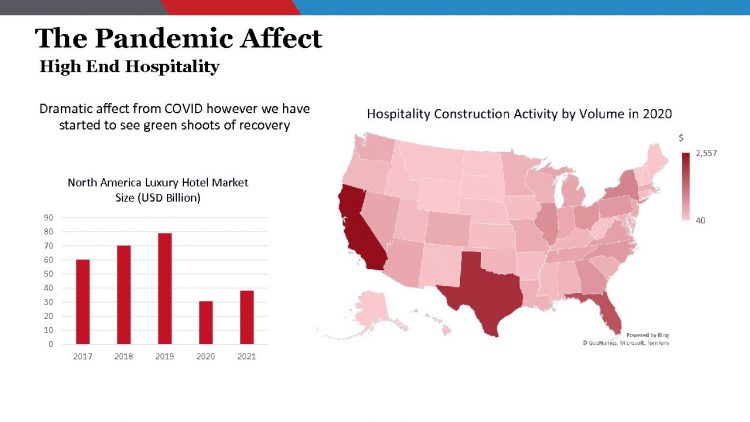

High End Hospitality

- Despite the dramatic effect COVID had on the luxury hotel market, w have started to see green shoots of recovery.

- More mid-range projects started to rear-up 6 months ago and more recently, the luxury hotel projects have followed suit.

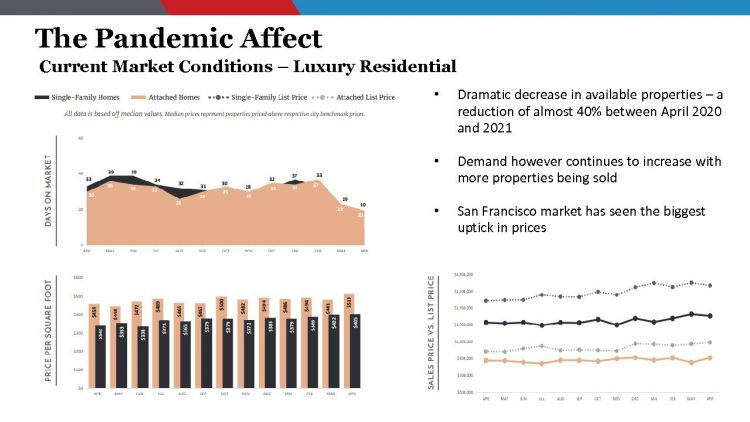

High End Residential

- We have seen a surge in activity, especially of larger complexes and significant activity in secondary and tertiary locations.

- There is uptick in locations with lower build costs and outside of main urban locations.

- Lower and mid-range residential was driven by lower mortgage costs which isn’t as much as a driver in luxury residential.

- Luxury house prices have increased, driven by an increase in demand and 40% drop of properties in the market.

Communicating with Clients

When communicating with clients, it’s important to rely on data and to be honest about the conditions of the market. Your clients are expecting a level of quality so you have to be clear of what the value is and you should provide the same quality of product and design to give them the project they signed up for. Some clients more date and others just want to know the outcome so you have to pick the right approach to your clients.

Keeping up with Data

Pick a resource that you trust, whether it’s contractor, consultant or subscription service. You shouldn’t be myopic about the data you seek because there indirect factors that will affect your work but you should be very clear of the specific information you are looking for. Stay connected with your stakeholders.

Moving in the Right Direction

- Making good decisions on materials that are less harmful to the environment, more durable and therefore sustainability should be communicated to clients through the lense of ROI.

- You can provide a cost benefit analysis to show how long it will take to payback the investment and in the long-term how much will clients be saving.